arizona real estate tax rate

The average effective property tax rate in. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the.

Rising Property Taxes Fill Gaps Pinch Homeowners Wsj

The total amount that will be billed in property taxes.

. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000. 52 rows Here is a list of states in order of lowest ranking property tax to highest. In 2012 Arizona voters passed a law that limits the growth of the LPV from one year to the next.

This marginal tax rate means that. The idea of paying taxes isnt necessarily a foreign concept especially for seniors who have been paying countless types of. In Arizona there are two semi-annual installments for property tax payments.

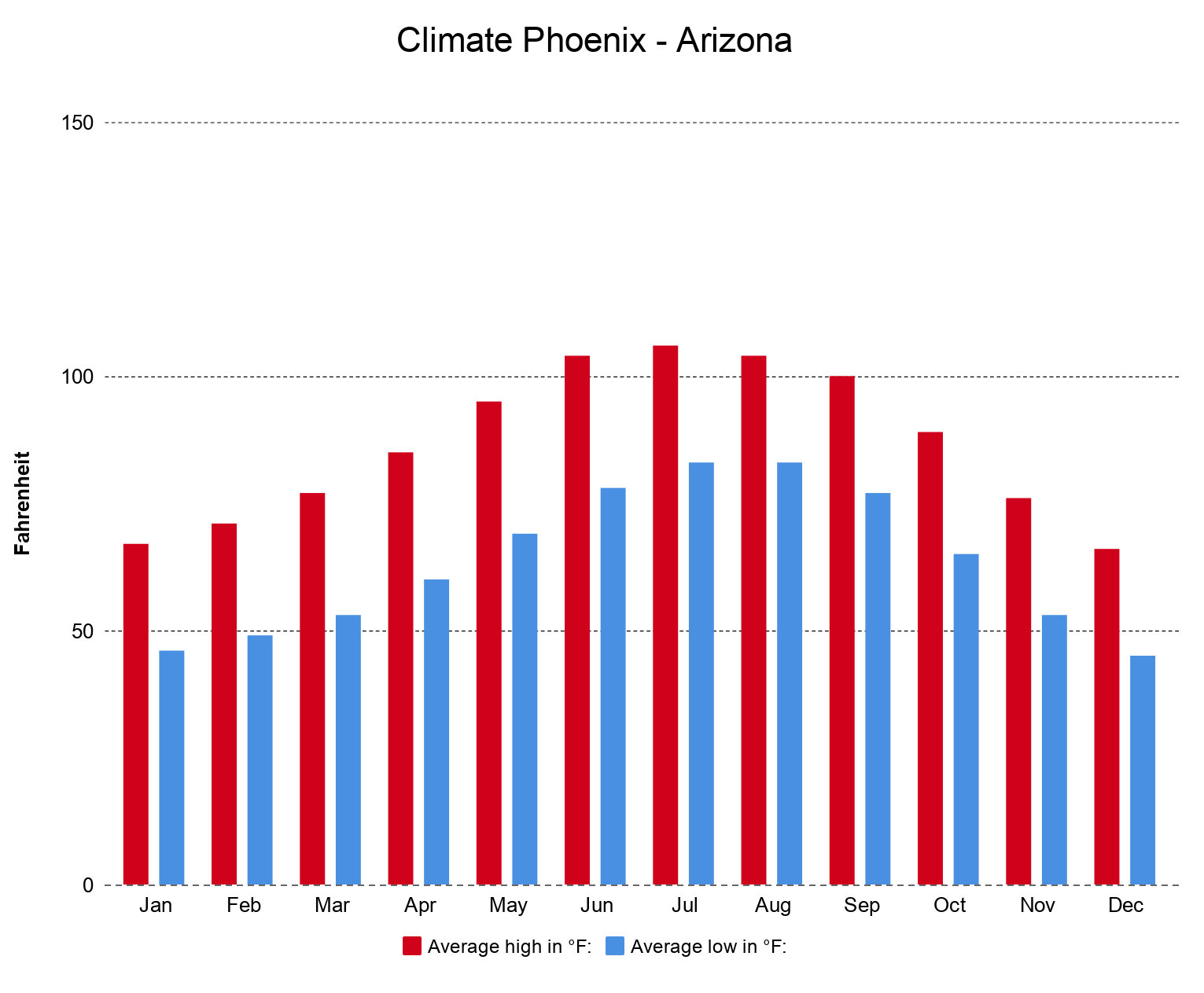

A property tax bill can be paid electronically or by mail to the County Treasurer of the county in which the property is located. If you need further assistance please call 602716-RENT 7368 or email. Income tax rates in Arizona range from 259 450.

Download Residential Rental Resources and Information Card PDF Learn About Tax Changes at Cities and Towns. Friday November 11 2022 Closed. If a property is mortgaged the property.

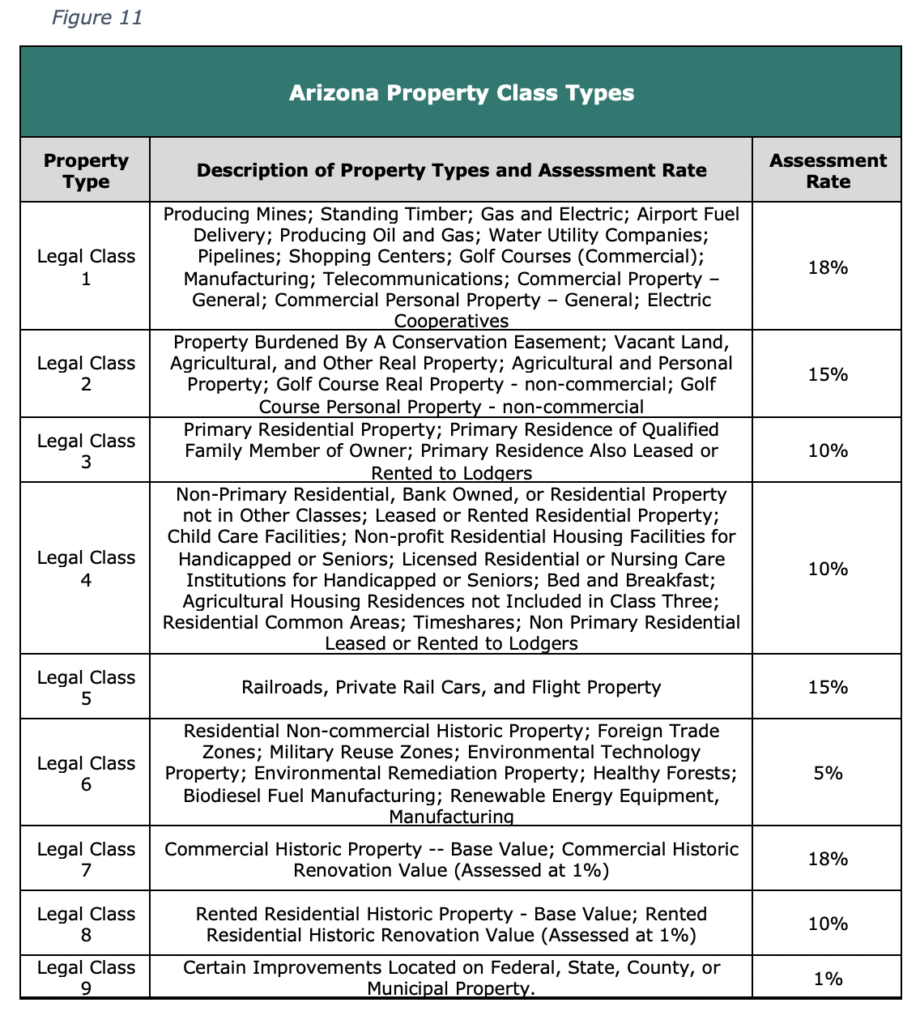

The average effective tax rate in the state is 062 which. 87 and 15 of the market value. Arizona Department of Revenue.

You can calculate your take home pay using our Arizona paycheck calculator. Friday November 25 2022 Closed. You can find this amount by calculation the.

View all options for payment of property taxes. All other budgetary categories including policefire hospitals parks. The rates for long-term capital gains taxes are 0 15 and 20 depending on the tax bracket the owner claimed while filing their tax return for that year.

View the history of Land Parcel splits. On average the tax rate in Arizona before all exemptions and potential rebates is usually between around. If you make 70000 a year living in the region of Arizona USA you will be taxed 10973.

Navajo County property taxes homepage. Thursday November 24 2022 Closed. Taxation of real property must.

1 be equal and uniform 2 be based on present market value 3 have a single appraised value and 4 be deemed taxable unless specially exempted. There are three basic steps in taxing real estate ie formulating tax rates estimating property values and taking in payments. The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homes.

Counties in Arizona collect an average of 072 of a propertys assesed fair. The tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. Arizona State Programs That Provide Property Tax Relief.

Your average tax rate is 1198 and your marginal tax rate is 22. Again real estate taxes are the main way Bullhead City pays for them including over half of all public school funding. Glendale determines tax rates all within Arizona statutory rules.

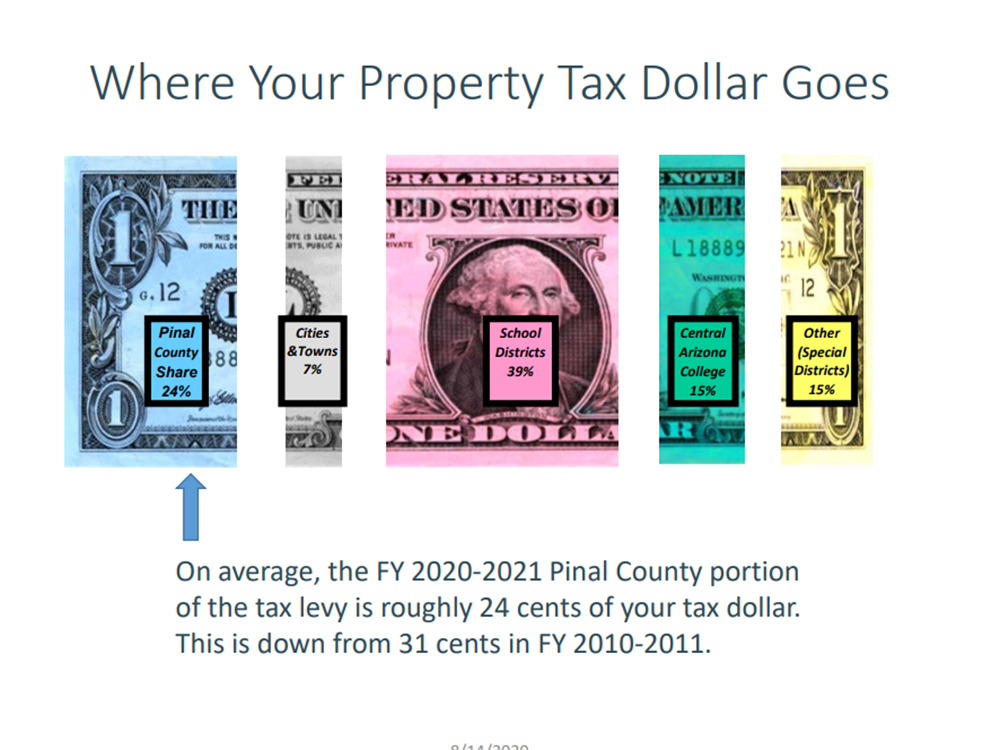

1600 West Monroe Street. Search the tax Codes and Rates for your area. Under Arizona law the government of Mesa public colleges.

However left to the county are appraising real estate sending out bills receiving the tax carrying out compliance efforts and. How do I calculate my.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

What I Need To Know About Property Taxes In Arizona

Arizona Property Taxes Are Lower Than Most Other States

Maricopa County Assessor S Office

Board Of Supervisors Cuts Property Tax Rate Works To Blunt Inflation In Tentative Fy 2023 Budget All About Arizona News

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Taxes In Arizona Lexology

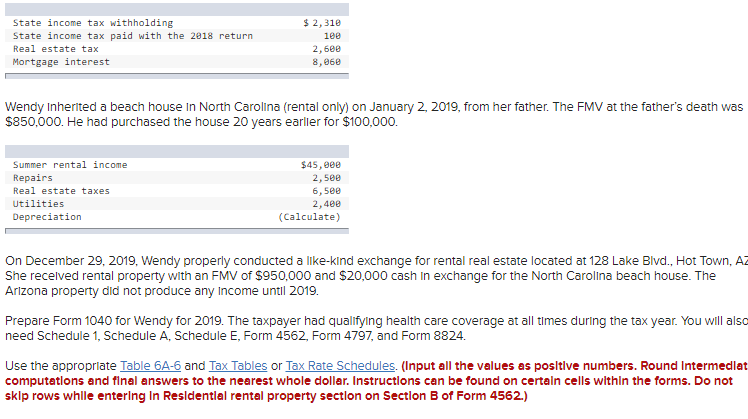

What Would The Depreciation Expense Be For This Chegg Com

What S The Arizona Tax Rate Credit Karma

Property Taxes In Arizona How Are They Assessed And When Are They Paid Homes For Sale Real Estate In Scottsdale Az Az Golf Homes

How Do State And Local Property Taxes Work Tax Policy Center

No Change In Proposed City Property Tax Rate The Bee The Buzz In Bullhead City Lake Havasu City Kingman Arizona California Nevada

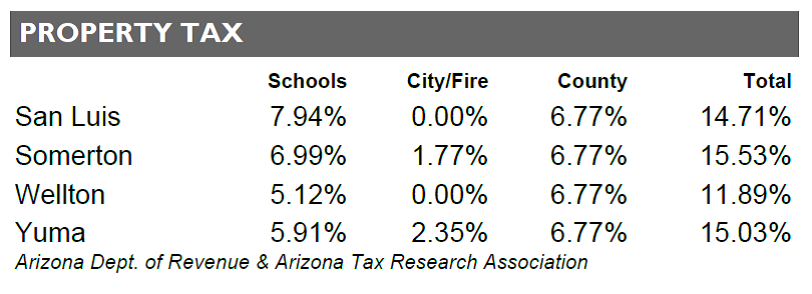

Yuma County Property Tax Process Yuma County

2021 Tax Rates Assessed Values Arizona Tax Research Association